💰 Learning Financial Intention with Our Kids

Raising grateful, money-aware children—without overindulgence.

In a world of instant gratification and influencer hauls, teaching kids about money is a quiet rebellion—and one of the most lasting legacies we can offer.

❤️ Why Financial Intention Matters to Us

We’re a family that values experiences over excess. Instead of lavish parties, we celebrate Paxton’s birthdays abroad—Germany one year, Anguilla the next. For his most recent birthday, we kept it simple with four close friends and a backyard hangout. We rarely exchange material gifts—not even for holidays. The first “gift” Jan gave me? A trip to Peru. My last birthday? A waterfall picnic hike while 7 months pregnant with Kai.

🛠️ Our Approach in Action

Letting kids feel the power of their own choices—one ice cream or toy at a time.

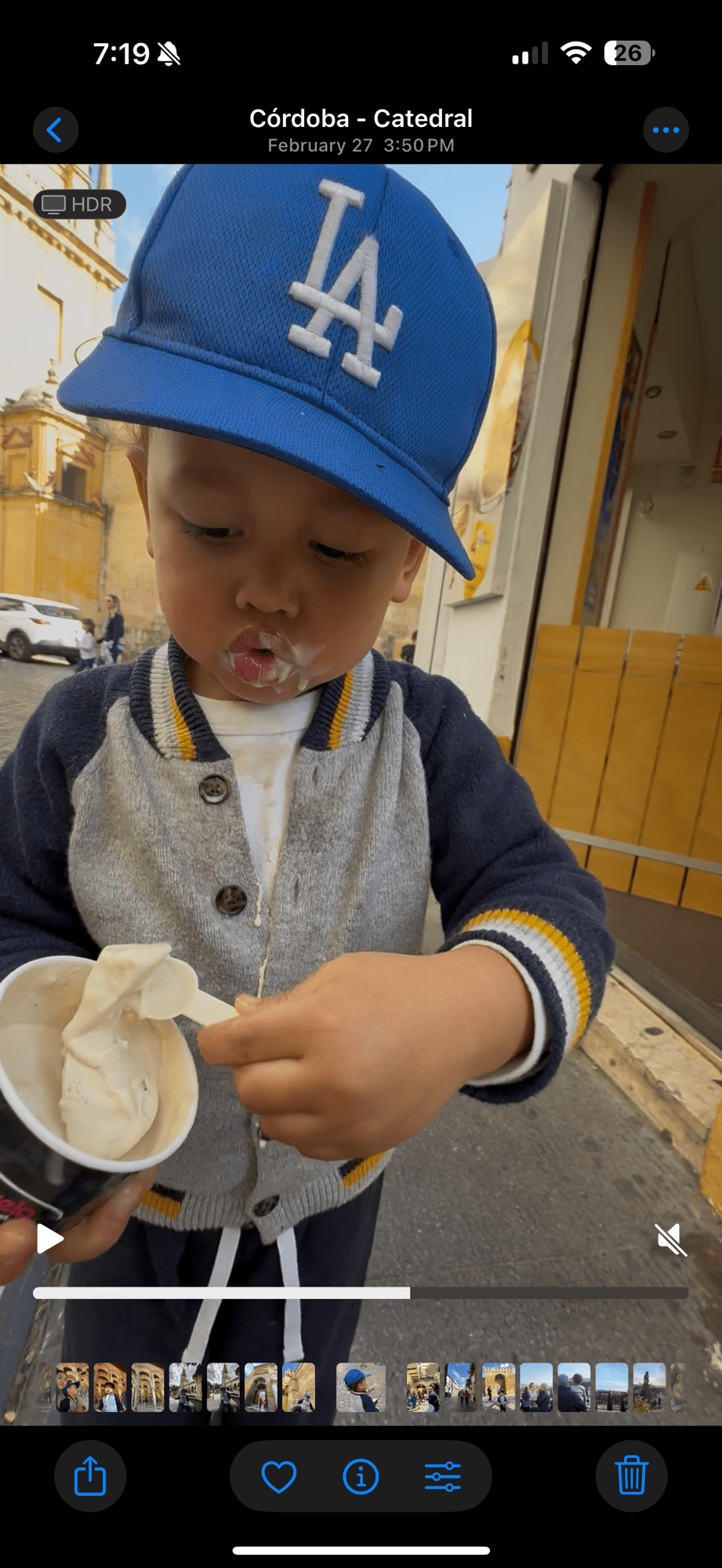

Paxton’s first taste of money decisions came at age three. While traveling through Córdoba, we handed him €10 and said, “This is yours.” He asked about prices, weighed options, and picked two small toys. But earlier that day, he’d mentioned wanting ice cream. I gently reminded him, and after a thoughtful pause, he put one toy back to save room—for joy.

Later, when he spotted another toy and asked for it, we calmly said, “You’re out of money.” He nodded and moved on. At three, he got it. And that quiet understanding was more rewarding than any purchase.

🔧 What We’re Building Toward

- Small weekly allowance tied to completed tasks

- Simple systems for spending, saving, and giving

- Conversations around needs vs. wants

✨ Why We’re Sharing This

This isn’t about perfection or preaching—it’s about exploring a different path. A slower one. A more intentional one.

“Raising financially conscious kids isn’t about how much they have—it’s about how they think about what they have.”

If you’re trying to raise kids with a heart for value over stuff, you’re not alone. We’re learning as we go—mistakes, wins, all of it—and sharing the journey with you.

💬 Still Learning—And Welcoming Your Ideas

This journey of teaching financial intention to our kids is ongoing for us. We’re not experts—just fellow parents figuring it out as we go, learning from our own research and trial and error. If you have tips, favorite resources, or lessons learned, I’d love to hear them in the comments!

📚 Helpful, Low-Pressure Resources

- The Opposite of Spoiled by Ron Lieber – A gentle, practical guide to raising money-smart, grounded kids.

- Make Your Kid a Money Genius (Even If You’re Not) by Beth Kobliner – Simple, research-backed tips for everyday families.

- Money as You Grow (CFPB) – Free, age-by-age ideas from the Consumer Financial Protection Bureau.

- Greenlight app – A kid-friendly debit card and allowance tracker (if you want to try digital tools).

(None of these are sponsored—just things I’ve found helpful or interesting in my own search!)

💡 Key Takeaways

- Start money lessons early—real choices with real (small) money make a big impact.

- Focus on experiences and gratitude over material gifts.

- Use allowance and spending decisions to teach needs vs. wants.

- Keep conversations open and non-judgmental—mistakes are part of learning.

- Model intentional spending and saving in your own life.

❓ Financial Intention FAQs

- What age should I start teaching my child about money?

As soon as they show interest—often around age 3–4. Simple choices and conversations go a long way. - How much allowance is appropriate?

Start small—$1 per year of age per week is a common guideline. Adjust to your family’s values and budget. - Should allowance be tied to chores?

Some families do, others don’t. We tie it to completed tasks to connect effort and reward. - How do you handle “wants” vs. “needs”?

Talk it out! Ask questions, share your own examples, and let kids make some low-stakes mistakes. - Any recommended resources?

Try “The Opposite of Spoiled” by Ron Lieber, “Make Your Kid a Money Genius” by Beth Kobliner, or apps like Greenlight for kid-friendly banking.

What does financial intention look like in your home? Let’s swap notes in the comments below.

Love real parenting stories like this?

Join our newsletter for honest family travel tips, thoughtful parenting insights, and free educational printables—sent straight to your inbox.